AI Adoption Elevates Finance Customer Experience

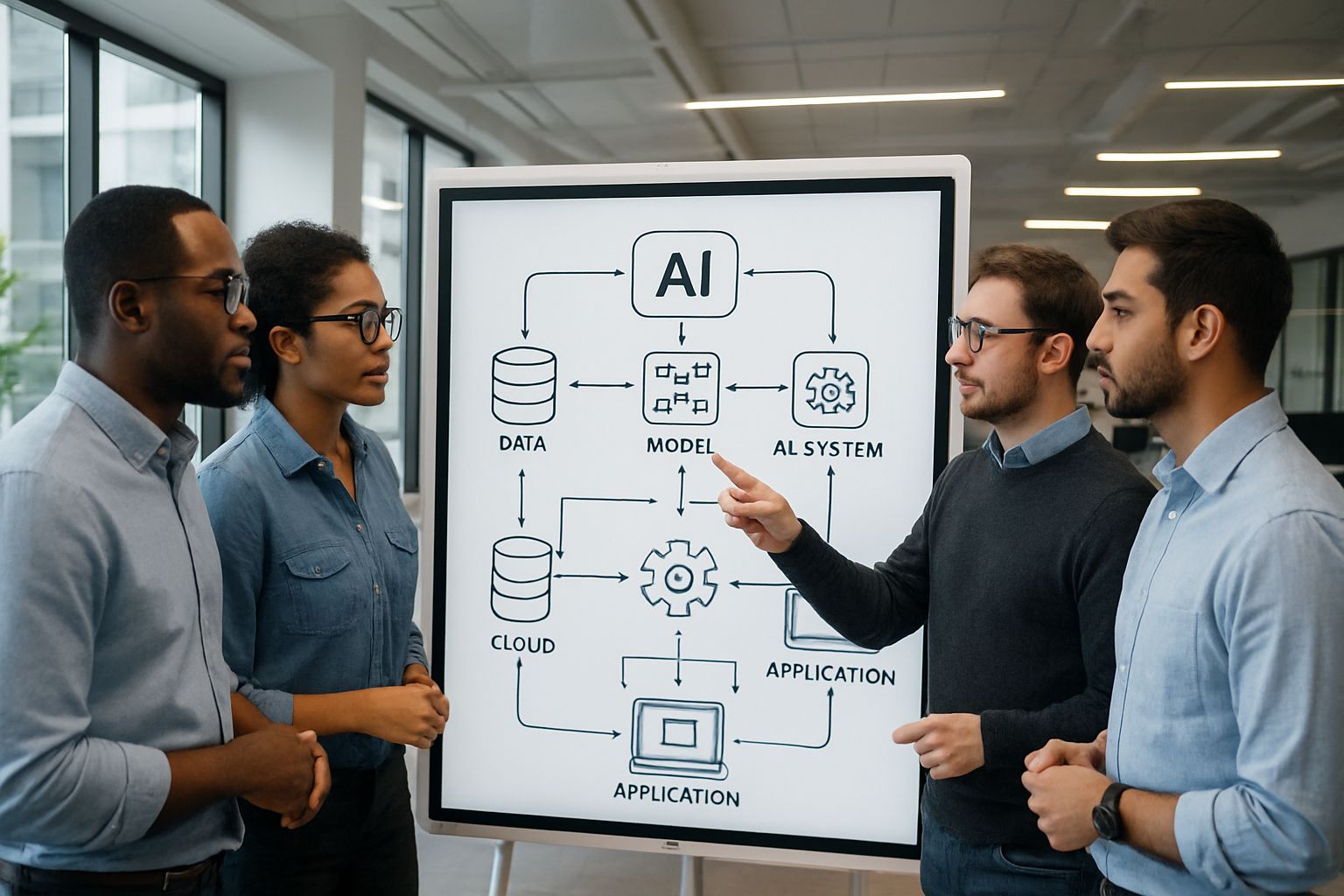

Finance customers now expect instant answers, seamless journeys, and context-aware advice. Yet many banks still struggle to deliver unified experiences across chat, branch, and mobile. AI adoption promises a step change. It turns fragmented touchpoints into personalized, always-on conversations.

However, frontline teams face tight regulations, rising fraud, and legacy processes. Consequently, leaders seek proven ways to pilot AI safely and show fast ROI. Recent success stories from ING, DBS, and other innovators reveal a clear playbook. This article unpacks that playbook, shows why governance matters, and explains how AdaptOps frameworks such as Adoptify.ai accelerate secure customer experience gains.

Readers will gain actionable steps, metrics, and guardrails needed to transform service moments within 90 days. The guidance serves enterprises, HR and L&D groups, SaaS providers, and transformation teams driving next-generation finance CX.

Finance CX High Stakes

Customer loyalty in finance remains fragile. Studies indicate that one bad digital interaction pushes 32% of consumers to competitors. Moreover, regulators continue raising service-quality expectations. Banks therefore face both revenue risk and compliance pressure.

McKinsey reports that agentic AI boosts relationship-manager revenue by up to 15%. Meanwhile, ING’s generative-chat pilot cut customer wait times sharply. These numbers prove that experience drives tangible financial returns.

Furthermore, Forrester forecasts tech budgets topping $4.9 trillion in 2025, with CX AI a prime investment theme. Consequently, executive teams now treat best-in-class digital service as a board priority.

Key takeaway: great finance CX protects revenue and satisfies regulators. Next, we explore why momentum accelerates.

Market Momentum Signals Soar

Gartner found 85% of service leaders plan conversational GenAI pilots by 2025. Additionally, spending on customer-facing AI in banks rises every quarter. Analysts attribute the surge to proven ROI and intense competitive pressure.

Agentic platforms now orchestrate outreach, prospecting, and query resolution. Consequently, relationship managers recover ten hours weekly for deeper client engagement. AI adoption plays a central role in this shift.

Meanwhile, fraudsters also weaponize AI, heightening urgency for secure deployments. Therefore, governance and monitoring demand equal attention alongside innovation.

Momentum is clear; yet barriers persist. The following section dissects them.

Common Adoption Barriers Unpacked

Even motivated banks hit roadblocks during AI adoption. Legacy cores, siloed data, and unclear ownership slow progress. Change fatigue further complicates rollouts.

- Fragmented data prevents omnichannel personalization.

- Weak governance exposes firms to compliance findings.

- Undefined ROI metrics stall funding for scale.

- Staff lack incentives to embrace new workflows.

Furthermore, rising AI-driven fraud raises executive anxiety. Nevertheless, structured frameworks can overcome these hurdles.

In summary, barriers span technology, risk, metrics, and people. The next section outlines a proven pathway.

Governance-First AI Adoption

Successful programs start with governance, not code. Adoptify.ai’s Readiness Assessment maps customer journeys and risk zones. The process yields acceptable-use policies, escalation paths, and monitoring standards before any model goes live.

Consequently, compliance teams gain clarity, and pilots run without delays. Furthermore, executive dashboards track real-time metrics, ensuring transparency. This approach aligns with GAO recommendations for human-in-the-loop controls.

When governance leads, AI adoption accelerates safely. Teams build trust, and funding follows results.

Key point: governance unlocks speed. Next, we examine the tactical playbook.

Agentic AI Playbook Essentials

Data Foundation Imperative

McKinsey advises creating a governed customer graph. Therefore, finance firms integrate identity, behavior, and product data into one feature store. This step powers consistent personalization across channels.

Human Guardrails Required

Red-team testing, output filters, and human fallback protect customers. Moreover, runtime monitors detect hallucinations and privacy breaches instantly.

Change Incentives Designed

Leaders adjust KPIs to reward conversation quality over speed. Additionally, L&D teams deliver role-based upskilling and micro-learning. Adoptify.ai supports these tracks with AI CERT pathways.

Closing this section: a robust playbook blends data, safety, and behavior design. Measuring impact comes next.

Measuring ROI Fast Wins

Pilots should run 6–8 weeks. Baseline metrics include containment rate, handle time, and Net Promoter Score. Adoptify.ai dashboards visualize gains within 90 days.

For example, Copilot pilots often save 60–75 minutes per employee daily. Additionally, some banks report 27% faster loan approvals. Such numbers fund subsequent rollout stages.

Moreover, transparent metrics improve stakeholder confidence. Consequently, AI adoption receives smoother budget approvals.

Summary: quick, quantified wins secure scale. The final section details that scale journey.

Scaling With AdaptOps Model

After a validated pilot, organizations enter Accelerate mode. Adoptify.ai expands user cohorts from 50 to 200 while refining prompts and policies. Quarterly reviews ensure alignment with evolving regulations.

Subsequently, Enterprise Transformation unlocks thousands of seats. Interactive in-app guidance drives feature discovery. Intelligent analytics surface friction points automatically, and support teams resolve issues faster.

Furthermore, the AdaptOps cadence embeds champions networks and continuous optimization. Therefore, customer experience keeps improving as models learn.

Final takeaway: a staged, AdaptOps journey turns pilot success into durable enterprise value.

Conclusion

The evidence is compelling. Finance leaders using AI adoption frameworks already cut wait times, lift revenues, and reduce cost-to-serve. Governance-first pilots, robust data foundations, and targeted upskilling make the difference. Metrics then prove value and unlock scale.

Why Adoptify AI? Our platform merges AI adoption expertise with interactive in-app guidance, intelligent user analytics, and automated workflow support. Consequently, enterprises onboard faster, boost productivity, and maintain security at scale. Discover how Adoptify AI streamlines your workflows today at Adoptify.ai.

Frequently Asked Questions

- How does AI adoption transform the finance customer experience?

AI adoption unifies fragmented touchpoints, enabling personalized, always-on conversations that enhance finance CX. This approach drives faster service, boosts loyalty, and provides seamless digital adoption for modern banks. - What benefits does a governance-first approach offer for AI pilots?

A governance-first approach ensures secure AI adoption with clear policies and real-time metrics. It mitigates compliance risks, accelerates pilot rollouts, and establishes trust with automated support and continuous monitoring. - How does Adoptify AI support enterprise digital adoption?

Adoptify AI streamlines digital adoption by combining interactive in-app guidance, intelligent user analytics, and automated workflow support. This integration helps enterprises onboard faster and sustainably scale their AI-driven initiatives. - How can finance teams measure ROI in AI adoption?

Finance teams can measure ROI using metrics like reduced wait times, improved handle times, and higher Net Promoter Scores. Clear dashboards and real-time analytics track performance, ensuring fast, quantifiable wins and budget-friendly scale.

FEATURED

How to Identify and Overcome Cultural AI Adoption Barriers

March 3, 2026

FEATURED

What Are the Most Common AI Adoption Challenges for Businesses

March 3, 2026

FEATURED

The Complete Guide to Building an AI Adoption Framework for 2026

March 2, 2026

FEATURED

Who Owns the Intellectual Property in Enterprise AI Adoption

March 2, 2026

FEATURED

7 Reasons To Embrace AI-Native Architecture

March 2, 2026