Avoiding Algorithmic Bias in Finance: AdaptOps Governance Guide

Financial institutions race to deploy generative credit, pricing, and valuation models. However, many overlook governance until regulators intervene. Avoiding algorithmic bias now defines competitive resilience. The cost of late remediation already tops multimillion-dollar settlements.

Consequently, boards demand clear plans for avoiding algorithmic bias across the entire AI lifecycle. This article outlines a governance-first playbook, anchored in Adoptify AI’s AdaptOps model. Readers will learn how to align compliance, architecture, and change management for responsible scale.

Avoiding Algorithmic Bias Mandate

Regulators have removed the black-box shield for credit algorithms. CFPB guidance forces lenders to explain every denial.

Meanwhile, the EU AI Act classifies many finance models as high risk. Mandatory impact assessments and monitoring follow. State attorneys general already impose costly remediation. Massachusetts secured $2.5M for disparate-impact underwriting this July.

Therefore, avoiding algorithmic bias is no longer voluntary; it is a legal duty with steep penalties.

CFPB Enforcement Case Lessons

Recent supervisory letters highlight missing documentation as the top finding across AI underwriting examinations. Therefore, maintaining rationale logs and feature provenance is now basic hygiene for finance developers. CFPB Director Rohit Chopra bluntly states, “There is no special AI exemption” for fair lending.

Similarly, OCC officials warn that ethical lapses will erode trust faster than any interest spread gained. Financial technologists should conduct quarterly fairness backtests. Additionally, they must share results with risk committees for accountability. Regulatory heat keeps rising across jurisdictions. And ignoring bias now invites rapid enforcement.

Next, we examine internal readiness gaps.

Governance Gaps Persist Widely

Surveys show 80% of banks pilot AI, yet under half document governance frameworks.

Consequently, many firms lack model inventories, change logs, or fairness tests. Evidence would be thin during audits. Analyst firms call this the adoption-governance gap. AdaptOps targets the gap directly with governed pilots.

Institutions that close the gap enjoy faster approvals and stakeholder trust. Additionally, they unlock larger budgets.

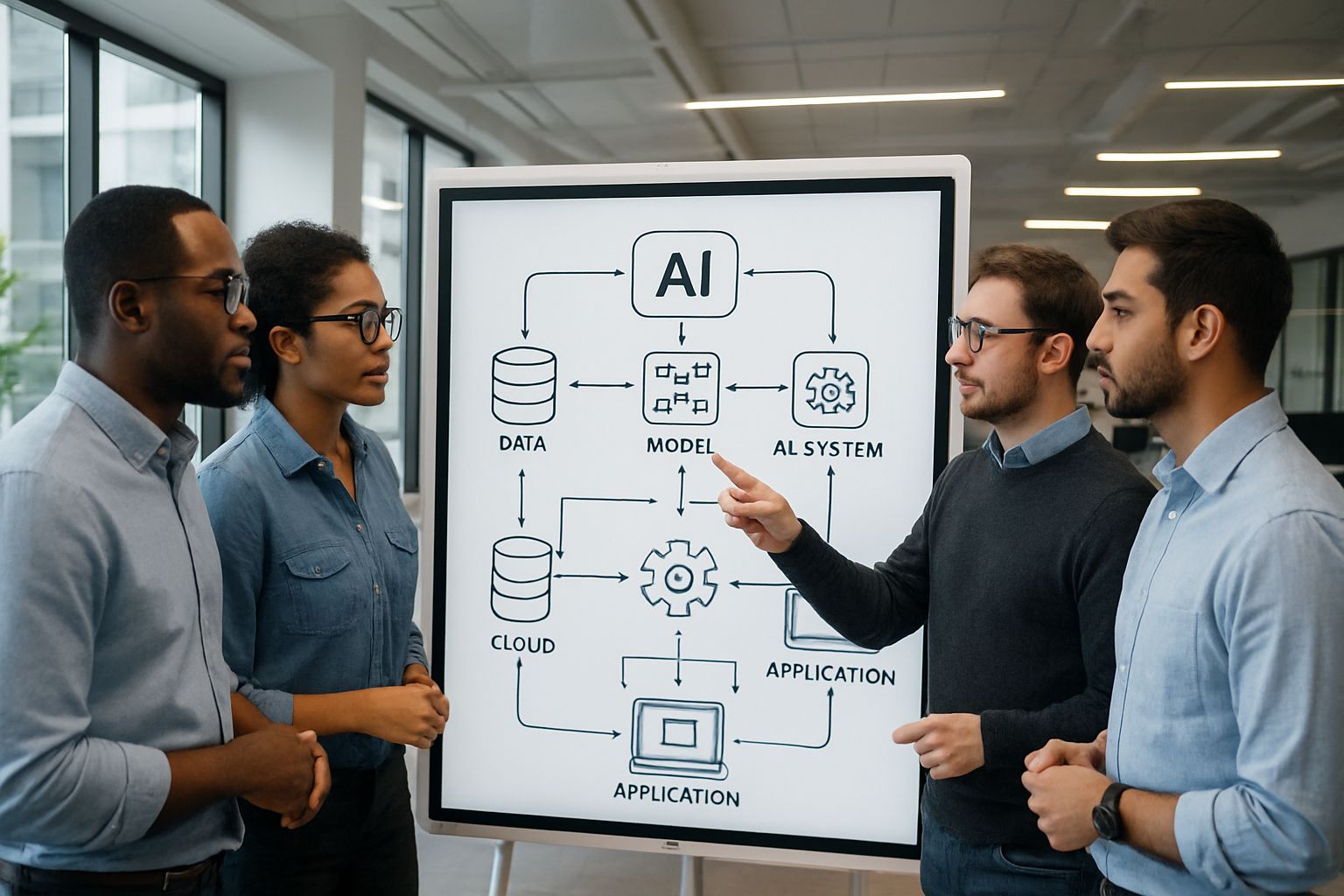

Inventory Foundations Come First

A central model inventory must record system purpose, owners, data sources, and current validation status. Also, tagging each system by risk level guides scarce testing resources toward high-impact areas. Siloed data science also undermines traceability. Developers change features without alerting compliance, breaking audit trails.

Moreover, many firms still rely on batch reports instead of real-time telemetry, delaying incident detection. Strong governance also accelerates vendor due diligence. Procurement teams trust solutions that provide built-in attestations and audit APIs.

Governance shortfalls remain the biggest internal risk.

Closing them is the first adaptation step.

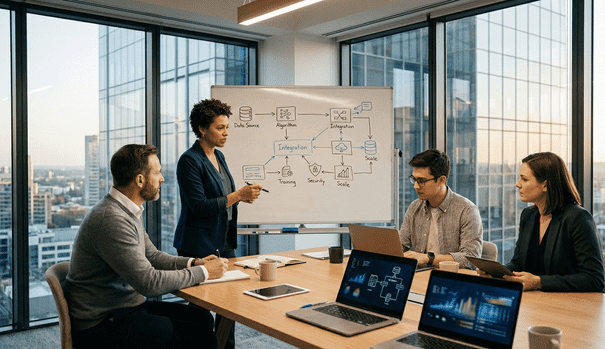

AdaptOps follows four iterative phases: Discover, Pilot, Scale, Embed. Each phase inserts governance gates.

During Discover, teams classify models by risk and run impact assessments aligned with ISO 42005.

Pilot limits exposure yet measures outcomes. Fairness tests, human oversight, and telemetry create audit evidence.

Scale reuses artifacts, automates monitoring, and connects fairness metrics to ROI dashboards.

Embed finalizes contestability workflows and role-based microlearning. Consequently, frontline staff handle adverse actions correctly.

Pilot Metrics That Matter

During pilots, teams measure Successful Session Rate, time saved per decision, and fairness margins.

Consequently, finance leaders see immediate gains alongside transparent risk indicators.

- Document model purpose and risk rating at creation.

- Identify sensitive features and plan mitigation strategies early.

- Run baseline fairness tests before user exposure.

- Attach telemetry hooks for real-time performance and bias monitoring.

- Schedule periodic retraining and governance reviews with clear owners.

Short, governance-heavy pilots deliver measurable ROI in weeks, persuading skeptical finance chiefs.

Subsequently, standardized model cards and feature registries cut onboarding time for later projects by 40%.

Successful Session Rate climbed from 68% to 87% across early adopters once governance gates hit production.

AdaptOps embeds compliance throughout delivery.

Continuous loops reinforce controls as models evolve.

Technical safeguards amplify these controls next.

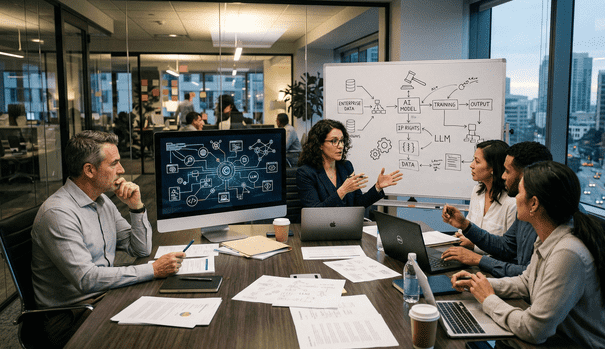

Key Technical Safeguards Needed

Technology must support the process, not replace it. Gartner now highlights AI observability as critical.

Responsible AI toolchains in Azure provide fairness dashboards, Purview lineage, and policy automation.

Adoptify AI integrates these signals into its SSR dashboards, linking productivity, revenue, and bias metrics.

- Data lineage and sensitivity tagging

- Pre-deployment fairness testing across groups

- Real-time drift and disparity alerts

- Versioned model and feature registries

- Explainable adverse-action reason codes

Observability In Live Production

Streaming pipelines push prediction and outcome data into metric stores every minute. Alert thresholds catch performance drift or disparate impacts long before quarterly reviews.

Cloud vendors now bundle bias dashboards with deployment pipelines. This native integration simplifies continuous fairness testing for engineers.

In contrast, legacy on-prem platforms demand custom scripts, which raise costs and introduce maintenance risks.

Together, these controls operationalize avoiding algorithmic bias for production workloads.

Consequently, engineers catch unfair shifts before consumers feel harm.

Teams integrate performance and fairness alerts into existing SIEM tools, ensuring incidents follow standard response playbooks.

Combining observability with ROI dashboards lets leaders see fairness breaches and revenue dips side by side.

Effective safeguards translate policy into code.

Automation reduces manual workload and miss risk.

People skills remain vital, as discussed next.

Change Management And Training

Tools fail when users misunderstand limitations. Role-based enablement raises fluency at every layer.

Adoptify AI’s AI CERT pathways deliver microlearning on model limits, disclosure rules, and contestability workflows.

Frontline staff complete short modules within existing systems. Meanwhile, leaders view completion dashboards.

These steps support avoiding algorithmic bias by embedding human oversight into day-to-day decisions.

Embed Contestability Support Workflows

Customers deserve fast dispute resolution when models err.

Adoptify AI routes disputes to human reviewers with contextual logs and suggested remediation actions.

- Adverse-action disclosure simulations

- Fair-lending law refreshers

- Data provenance quick checks

- Drift response playbook practice

- Bias root-cause workshops

Human stories reinforce learning. Trainers share past enforcement cases to illustrate how seemingly neutral data creates inequity.

Consequently, employees internalize responsibilities rather than treating governance as distant compliance paperwork.

Annual skills recertification keeps knowledge fresh as regulations evolve and new fairness metrics emerge.

Training converts policy into practice.

Continuous learning keeps knowledge current.

Value proof is the final requirement.

Proving Value With Metrics

Executives fund programs that show returns. Forrester TEI studies cite 132-353% ROI with governed AI.

Adoptify AI dashboards present SSR, minutes saved, error reduction, and fairness trends in one view.

Therefore, avoiding algorithmic bias becomes part of the value story, not a compliance cost.

Boards see clear evidence of reduced risk and improved customer trust, sealing budget approvals.

Dashboards For Busy Boards

Board members prefer concise visuals over raw SQL queries.

Adaptify AI tiles highlight adoption, revenue, risk, and customer outcomes on a single page.

Telemetry also supports proactive maintenance. Drift alerts trigger retraining before performance and fairness metrics degrade.

Meanwhile, consolidated dashboards let’s executives compare productivity gains against risk reduction in one glance.

Real-time metrics also inform capital planning models, aligning risk buffers with observed performance trends.

Quarterly board reports exported from Adaptify templates satisfy ESG and Responsible AI disclosure expectations.

Metrics translate fairness into money language.

Budgets follow when data convinces.

The journey concludes with strategic recommendations.

Conclusion

Financial AI cannot scale without disciplined governance. AdaptOps inventories models, gates pilots, monitors fairness, and trains staff.

By avoiding algorithmic bias, firms comply with CFPB, state, and EU rules while protecting customers.

Why Adoptify AI? The AI-powered adoption platform delivers interactive in-app guidance, intelligent analytics, and automated workflow support.

You gain faster onboarding, higher productivity, and enterprise-grade security.

Intelligent dashboards link fairness metrics to ROI, giving executives real-time confidence. Moreover, embedded microlearning ensures skills never lag behind evolving rules.

Consequently, deployments stay compliant and profitable. Act before regulators dictate your timeline.

Moreover, the platform scales across HR, sales, and operations, centralizing governance under one secure roof. Seamless integrations with Microsoft, SAP, and Workday reduce change friction further.

Start your AdaptOps journey now at Adoptify AI.

Frequently Asked Questions

- What is AdaptOps and how does it help avoid algorithmic bias?

AdaptOps is Adoptify AI’s structured process that manages model inventory, pilots, and continuous monitoring. It minimizes algorithmic bias by integrating fairness tests, in-app guidance, and automated alerts for responsible AI deployments. - How does Adoptify AI support compliance and governance for financial AI?

Adoptify AI enhances compliance with interactive in-app guidance, robust dashboards, and automated workflow support. It streamlines model documentation and real-time bias monitoring, aligning with CFPB, EU, and state regulations. - How does in-app guidance enhance digital adoption and workflow intelligence?

In-app guidance simplifies digital adoption by providing role-based microlearning and real-time tips. This feature, coupled with intelligent analytics, improves workflow intelligence and ensures users maintain strict compliance while managing AI models. - What role do real-time dashboards and alerts play in mitigating AI risks?

Real-time dashboards offer comprehensive insights by linking fairness metrics to ROI. Automated alerts and bias monitoring support proactive risk management, ensuring rapid detection and mitigation of potential AI compliance issues.

FEATURED

How to Identify and Overcome Cultural AI Adoption Barriers

March 3, 2026

FEATURED

What Are the Most Common AI Adoption Challenges for Businesses

March 3, 2026

FEATURED

The Complete Guide to Building an AI Adoption Framework for 2026

March 2, 2026

FEATURED

Who Owns the Intellectual Property in Enterprise AI Adoption

March 2, 2026

FEATURED

7 Reasons To Embrace AI-Native Architecture

March 2, 2026